A MAN FOR ALL MARKETS

Edward O. Thorp (2017), Oneworld Publications

Notes & Extracts

Understanding and dealing correctly with the trade-off between risk and return is a fundamental, but poorly understood, challenge faced by all gamblers and investors. (p.58)

A colleague asks Thorp for his thoughts on an academic career: “I told of the glories of the life of the mind, to be able to think about interesting problems as much as you wanted, to interact with intellectually challenging colleagues and students, to learn about any subject you chose, to have a lot of discretionary time with summers to travel and research.” (p.101)

Blackjack: Card-counting: a simple way of playing High-Low blackjack, where:

cards 2-6 = +1

cards 7-9 = 0

cards 10-Ace = -1

As each card is revealed, and starting at zero, keep a running total. A positive count provides an edge to the player; a negative count favours the dealer. (p.115-6)

Roulette: His association with Claude Shannon on the application of physics to roulette, circa 1960 (ch.9)

The motion of the [roulette] ball is complicated by having several different phases, making it so daunting as to discourage analysis. (p.124) We found that we could predict, with a high degree of accuracy, when and where the ball would slow enough to fall from the circular track. Most wheels had deflectors – typically eight – that the ball would frequently hit. We found that the uncertainty this introduced into our prediction was too small to ruin our advantage. (p.125)

We needed a measure of uncertainty of sixteen pockets [a 0.42 portion of the roulette wheel] or less to get an edge. We achieved a tighter measure of ten pockets [a 0.26 portion]. If we spread our bet over the two closest numbers on each side [of our prediction], for a total of five numbers in all, we cut risk and still had [an edge]. (p.126)

I bet each time on a group of five numbers that are adjacent on the rotor. The French call a group like this a voisinage, or “neighbourhood”. Using our computer, our bet on five numbers won a fifth of the time, giving us a 44% edge. (p.132-3)

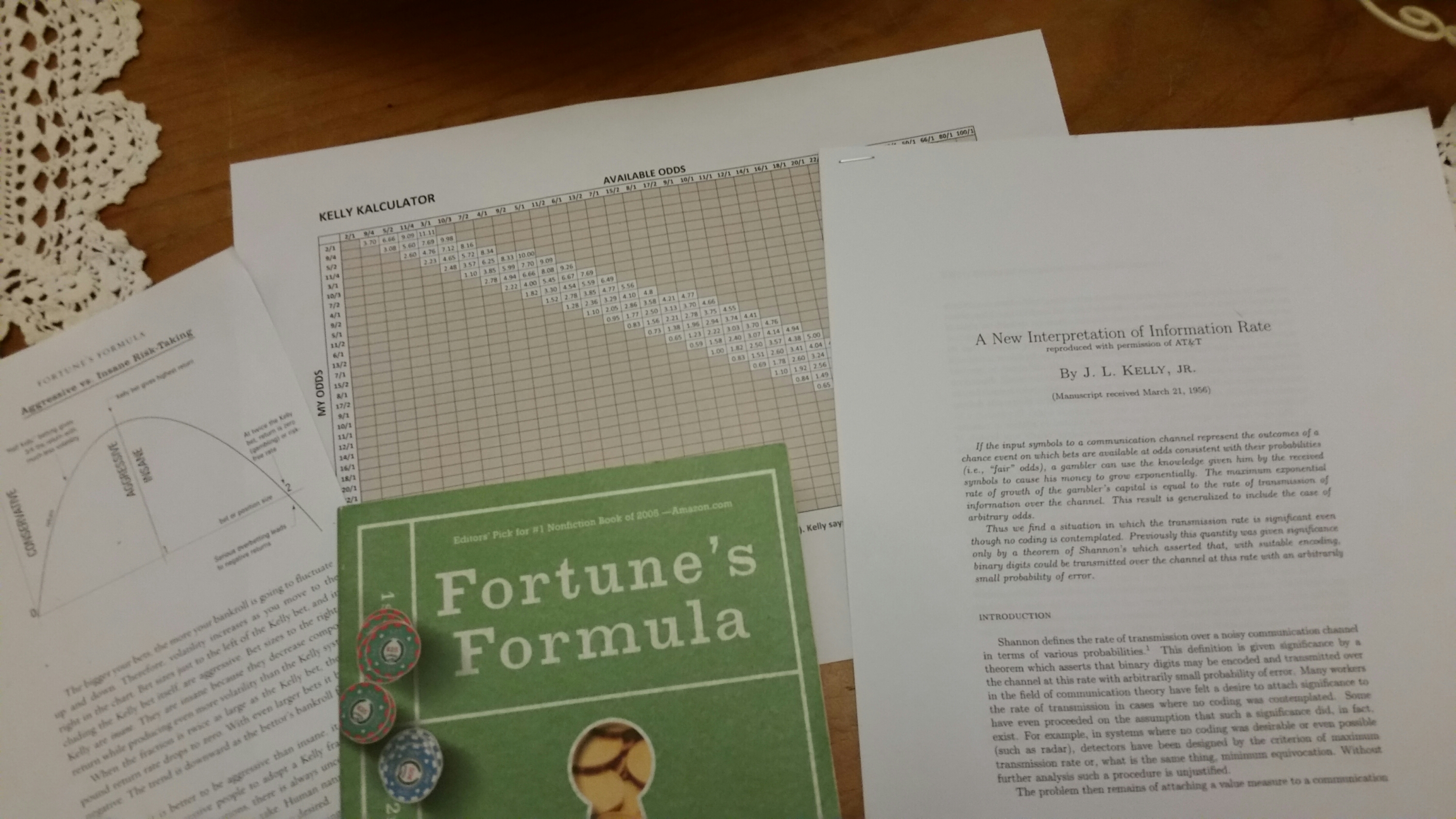

For bet sizing in favourable games, Shannon suggested I look at a 1956 paper by John Kelly. I adapted it as a guide for bets in blackjack and roulette, and later in other favourable games, sports betting and the stock market. (p.129)

Claude and I corresponded for a few years. The last letter I remember writing was in late 1965 or early 1966, where I recalled our discussions about the stock market – triggered by my seeing on his blackboard the figure 211 which equals 2048, an investing goal he was contemplating. (p.135)

Baccarat: In the Nevada version of baccarat, Bill Walden and I discovered that a card counter couldn’t beat the main Banker and Player bets, but could beat the four separate side bets: Banker natural 9, Player natural 9, Banker natural 8 and Player natural 8. We devised a practical card counting system, which used the fact that when the remaining cards had an excess of 9s, the natural 9 bet favoured the Player. An 8-rich deck did the same for bets on Player natural 8. (p.139)

We validated the theoretical mathematical calculations and demonstrated yet another application of the Kelly system for betting and investing. (p.143)

Wall Street: Gambling is investing simplified. Each requires money management, choosing the proper balance between risk and return. Betting too much, even though each individual bet is in your favour, can be ruinous. Playing safe and betting too little means you leave money on the table. (p.145)

On Warren Buffett: From 1956 to 1968 funds managed by Buffett Partnerships Ltd (ie before Berkshire Hathaway) compounded at a rate of 29.5% – or 24% after fees. (p.156)

Buffett: “Be fearful when others are greedy and greedy when others are fearful”. (p.159)

On his hedging company Princeton Newport Partners (PNP): Betting on a hedge I had researched was like betting on a blackjack hand where I had the advantage. As in blackjack, I could estimate my expected return, estimate my risk, and choose how much of my bankroll to bet. Instead of a $10,000 bankroll, I now had [an investors’ fund of] $1.4 million, and instead of a $500 maximum bet, the Wall Street casino had no limit. We started betting $50,000 to $100,00 per hedge. {Note $50k = 3.57% of starting bankroll} (p.167)

When Fisher Black and Myron Scholes published their formula, the same one I was already using, I knew that to maintain PNP’s trading edge I would have to develop my tools. (p,185)

From 1969 to 1979 we were up 409% for the decade, annualising at 17.7% before fees. Our initial $1.4 million had grown to $28.6 million. The annual return for the S&P 500 was 4.6% (p.194)

From 1979 to 1988 our capital expanded from $28.6 million to $273 million, an annual rate of 22.8% before fees. The S&P 500 compounded at 11.5%. We were much less risky and had no losing years or losing quarters. (p.202)

As PNP closed [in 1988] I reflected on the proposition that what matters in life is how you spend your time. (p.211)

According to the theory of efficient markets (EMH), the market sets prices so that they accurately reflect all available information. (p.227) Neither Jerry [Baesel] nor I believed the efficient market theory. We didn’t ask, Is the market efficient? but rather, In what ways and to what extent is the market inefficient? (p.236)

Hedging your bets supposedly protects against catastrophic losses. But when the 2008 recession hit, many investors in hedge funds lost heavily. The S&P 500 fell 57% from its Oct ‘07 high. Hedge funds, which were supposed to protect investors against such declines, dropped an average 18% (p.258)

Doing better than the market is not the same as beating it. The first is often simply luck; the second is finding a statistically significant edge that makes sense, then profiting from it. (p.292)

To beat the market, focus on your “circle of competence”. (p.300)

Our corporate executives speculate with their shareholders’ assets and they get big personal rewards when they win – and even if they lose, they are often bailed out with public funds by obedient politicians. We privatise profit and socialise risk. (p.333)

Kelly Criterion: When I deployed my card counting system for blackjack, it made intuitive sense to bet more when the expected gain, or edge, was greater. The question was, how much? The answer was in a 1956 article by Bell Labs physicist John L. Kelly, who some said was the smartest person there, after Claude Shannon. Kelly showed mathematically that the wealth of someone following his system would exceed the fortune of a competitor using a different scheme. From blackjack I went on to use Kelly’s formula to manage bets in baccarat and to allocate money among investments. (p.310)

Some key features of the Kelly Criterion are: (1) the investor generally avoids total loss, (2) the bigger the edge, the larger the bet, (3) the smaller the risk, the larger the bet. (p.310)

Three caveats: (1) Kelly may lead to wide swings in total wealth, so “most” users choose to bet some lesser fraction, typically one-half Kelly or less, (2) for investors with short time horizons or who are risk-averse, other approaches may be more suitable, (3) an exact application of Kelly requires exact probabilities of payoffs – to the extent that these are uncertain, the Kelly bet should be based on a conservative estimate of the outcome. (p. 310-11)

@BacchyRaces Mar21

For more resources see edwardothorp.com